ORDINARY LOAN

1. Members are eligible to apply for loans after 1 month of becoming a member & can stand as surety to loan- applicants (It may change from time to time).

2. Maximum credit limit (MCL) of a member is 10-50 times of his/her share value, or Rs. 10,00,000/-, or 10/12/15 times his/her total monthly emoluments (net Income) whichever is less.

3. For eligibility of Loans on the basis of duration of membership please refer last page or www.southernstar.org.

4. At the time of consideration of Loan application, the applicant (Loanee) should possess sufficient number of shares. i.e., for a loan of Rs. 50,000/- the applicant should possess a minimum number of 10 shares (Rs. 5,000/-). i.e. loan limit is 10 times the share value. If the number of shares is not sufficient, value of such number of shares will be deducted from the Loan amount granted.

5. Surety should also possess sufficient number of shares according to the Maximum Credit Limit (MCL). A member can avail loan upto 10-50 times of the share capital and can also stand as surety for loans up to 50 times. If a member is not availing the loan facility by self, he/she can stand as surety upto 50 times of the share value. Depending on the re- payment of instalments by the Principal Loanee, his surety liability will be reduced proportionately. Further he/ she can stand as surety for the remaining amount. Society will not disclose the surety eligibility of a member to another member, before signing the loan application form, whoever he/she may be (except in case of husband, wife & dependents). The concerned member should personally collect such details from the Society’s office. If the surety is not eligible with respect to the number of shares, it has to be increased at the time of disbursement of the Loan.

6. At the time of consideration of Loan, the applicant (Loanee) may clear the ordinary loan balance in his account, or it shall be deducted from the loan taken, provided 1% of the loan balance will be charged as ‘renewal fee’ with GST of 18%. This facility is allowed only to the members with excellent payment habit.

7. It is the discretion of the M.C. to sanction or reject a loan application. It may ask for additional sureties and collateral securities or it may reduce the loan amount applied for, whichever the M.C. finds suitable.

8. Loanee should visit the Society Office and complete all the formalities like signing the membership register, specimen signature card and preparation of Identity Card etc. (if not done already).

9. Completed application in all respects should reach the Society Office one day prior to the M.C. meeting. Preliminary checks will be held on the spot and the same will be entered in a separate register kept for this purpose, and serial number of the register will be communicated to the member. The deficiencies and/or further requirements, if any, found during the preliminary checks will be communicated to the member then and there. Please note that applications received on the day of the Committee meeting will not be considered in that meeting and it will be kept pending till the next meeting. Loans are issued to members on first-come-first-served basis (in case of waiting list).

10. Loan application will be scrutinized by the Loan committee in their meetings (normally on all Sundays). Issue of loans will be made only after it is passed by the Committee. At present, loans are issued on Sundays between 10.00 A.M. to 3.00 P.M. and on Wednesdays & Saturdays between 11.30 A.M. and 7.30 P.M. Loanee should be present himself/herself at the time of disbursement of loan. If any other formality is incomplete before the disbursement of the loan, it is to be complied before disbursement.

11. Concealment of facts, fraud in signature, etc. will lead to rejection of the loan application.

12. Proper Income certificate should be submitted along with the loan application, and the M.C. should be convinced of the re-payment capability of the member.

13. Members can avail loans up to 10 times their total monthly emoluments (Net Income) for loan up to Rs. 1,00,000/-; 12 times for loans between Rs.1,00,000/- to Rs. 3,00,000/-, and 15 times for loan above 3,00,000/-.

14. If the applicant is a Govt. employee, submit a latest salary certificate issued by the Pay & Accounts Officer of the Office/Department, where he/she is employed.

15. If the applicant is a married woman, husband should be an additional surety and at least three sureties should be male members.

16. If the applicant is an unmarried woman, then at least four sureties should be male members.

17. If the applicant is a permanent Govt. woman employee, clauses 15 & 16 above shall not be applicable, subject to the payment habit of the member concerned.

18. Payment habit and credibility of sureties will also carry weightage.

19. Only one surety from one house will be allowed on an application.

20. Residential address and employment of Loanee and sureties will be verified, especially in case of new members with less than 5 years of membership.

21. For members residing outside Delhi/NCR there will be no Ordinary Loan.

22. House-wives and self employed persons residing outside Delhi are not eligible for Ordinary Loan.

23. If one member is a surety to an unpaid debt/loan, neither his resignation from the society will be accepted nor the deposits adjusted. However, the surety’s liability can be transferred to another person subject to his eligibility and M.C.’s approval, the account can be closed/ adjusted.

24. Loans are not issued to persistent defaulters. Loanee and their sureties should clear off their dues to the Society before their application for loan and acceptance of their sureties are considered.

25. Notices shall be issued to the Loanee, sureties and employers on default of loan re-payment instalments. Arbitration cases are processed on default of 5 months or more. All expenses in connection with arbitration proceedings as well as preparation charges will be recovered from the loanees/sureties/employers.

26. After arbitration, the dues will be treated as Govt. dues and arrest warrant could be issued by the Delhi Govt. against the member/sureties and also could be remanded to Judicial custody (Tihar Jail) till recovery of the amount. Hence the members may give surety on their own risk. It is advised to give surety to well- known members with good payment habit only. M.C. is empowered to deduct all the dues of a defaulting member from the surety’s (guarantor) and their spouses’ and dependents’ accounts/deposits.

27. If a member is a surety to a defaulter, he/she and their spouse as well as dependents are not eligible to stand as another surety or avail loan facility themselves.

28. Rate of interest on Loan is now 10% P.A. (Subject to change from time to time) reducing half monthly (Fortnightly reducing). If instalment is not paid by 15th of the month, 3% additional (penal) interest will be charged on the entire outstanding loan amount. Interest is charged in advance half monthly. i.e., a member availing loan between 1st and 15th of a month will have to pay one and half month’s interest in the next month on or before 15th. But members availing loan between 16th and 31st of a particular month will have to pay one month’s interest in the following month on or before 15th.

29. Loans are repayable in monthly instalments given separately.

30. Loan instalments can be paid in advance too. In that case, the member saves the interest, and the loan period will get reduced. Default in Loan repayment instalments will affect future loan applications and hence the members may default at their own risk.

31. Members can deposit post-dated cheques with the society and it will be presented to the Bank every month regularly. Payments are also accepted through Net-Banking/NEFT/RTGS/IMPS.

32. Documents to be attached with the loan application: Besides completing the application form, a member must also ensure that the following documents are supplied with his/her application.

a) Income (salary) certificate recently issued by the employer as per the proforma (for salaried employees other than Govt./ Undertaking/ Ltd. Company employees).

b) Salary Slip (computerized) recently issued by the employer duly signed and sealed (for Govt./ Undertaking/ Ltd. company employees).

c) For self-employed persons, affidavit (as per proforma supplied by the Society) showing income and detail of business with address bank statement (for loan less than 1,00,000/- and without property mortgage).

d) For self-employed, last 3 years’ audited balance sheet with Tax deposit proof (for loan above 1,00,000/-, and without property mortgage).

e) For self-employed, affidavit showing income and detail of business with address and bank statement for two years (For loan up to Rs. 10,00,000/- in case of loan against property mortgage).

f) For housewives, income certificate of their husband, along with an undertaking from the husband.

g) Bank passbook/statement copy for last one year (for all cases).

h) Proof of permanent address, if not submitted earlier. (SSLC/Passport/ Aadhaar Card/Birth Certificate/ Property documents/Voter ID Card/Ration Card- issued by competent authority from Kerala). Proof of latest local address for all cases. (PAN card/Voter ID Card/ Passport/Aadhaar Card/Driving License/LIC policy/ Telephone Bill/ Electricity Bill etc) – KYC compliance.

i) Recent passport-size photograph, if not submitted earlier.

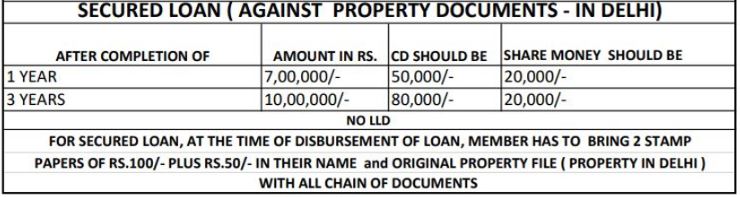

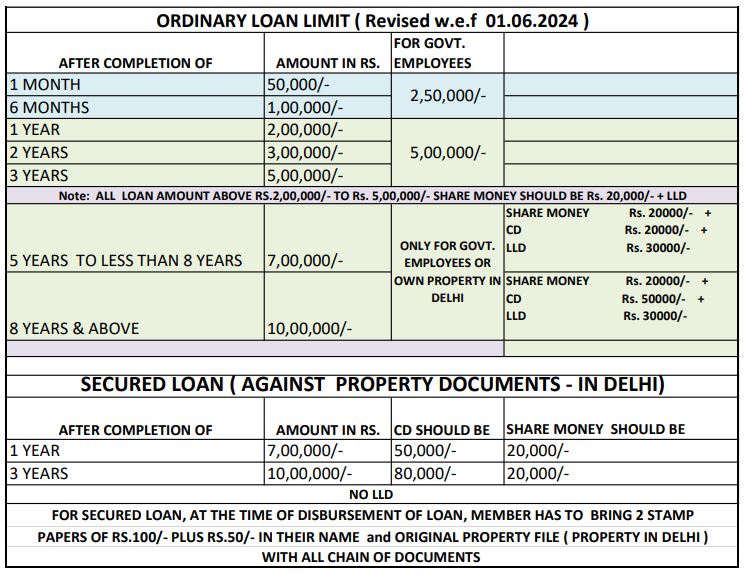

ORDINARY LOAN LIMIT |

Note: For loan amount above Rs. 2,00,000/- Share money and CD should Rs 20,000/- + Loan Linked Deposit (LLD). LLD will be 10% of loan amount above Rs 2 lakhs and is refunded or adjusted with the last loan instalment/s.